Why Outsource?

How do our services provide value?

What are the benefits to you and your business?

We know your pain points…

- Hiring accounting staff

- Invoicing government contracts

- Dealing with Federal Acquisition Regulations on a daily basis

- Doing your own bookkeeping after 8 hours on a contract

- Trying to figure out what the heck went wrong with the accounting system

- A profit & loss statement for June…..in September

- Moving timesheets and costs because you charged to the wrong task order

- Forgetting to enter bills or even pay the bills because…you were busy on a contract

- Not having the data on hand to bid on a new proposal

- Coding every transaction correctly in accordance with FAR, GAAP, DCAA, CAS, and so on and so on

- Not being able to take a day off AND not catch up the books

- Not having coverage when your in-house bookkeeper goes on vacation

- Having to pay extra for another accountant to clean up the mess you made

- You REALLY don’t like dealing with the day-to-day accounting

- You’d prefer if someone just takes this all off your plate…

Our Value Proposition..

- We are specialist in government contract accounting

- We love accounting, we love financial analysis…we love numbers!

- Our 3-tier virtual CFO services are more cost-effective than hiring and managing in-house

- You gain expertise in every service area that we provide

- You benefit from real-time financial information, already coded correctly and posted on time

- You don’t have to train our staff and we are responsible for hiring the people we need to get the job done

- We can reduce the clean up, tax notices, and other compliance stressful issues

- We can assist in your strategy planning, directors meeting, and business growth with accurate information

- We are already your trusted advisor

- We are happy to take the burden off of your plate

The case AGAINST keeping accounting in-house

When you hire in-house accounting staff, you will require multiple people to get accurate, real-time financial data. Here are average nationwide (US) salaries of key accounting positions. In addition to the salary, add another 30-40% for employee benefits and payroll taxes.

| Position | Median | 75th percentile |

| Chief Financial Officer |

141,022

|

213,070 |

| Controller | 98,754 | 122,959 |

| Accounting Manager | 83,178 | 103,566 |

Sources: Zip Recruiter, Payscale, Glassdoor, Carta, National MAP Survey, US Department of Labor

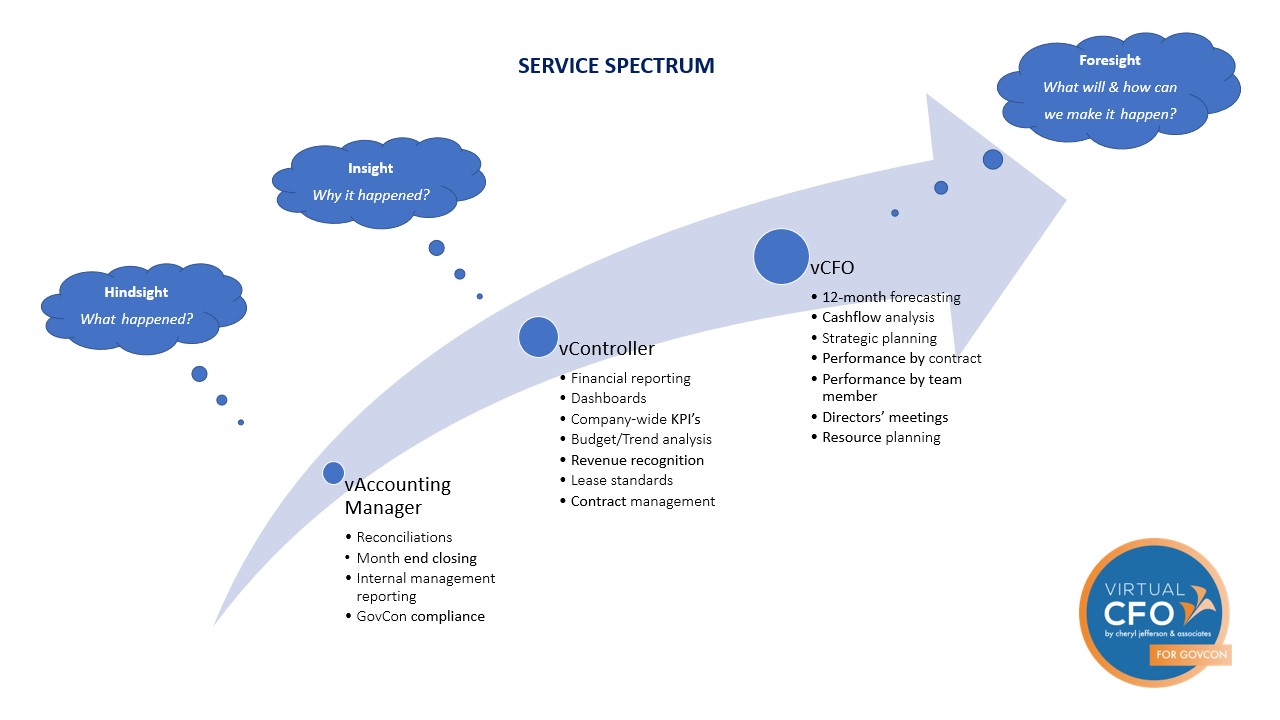

Service Spectrum

Choose A Tier That Works For You!

Our pricing tiers are targeted for government contractors and the unique regulatory rules they must follow. If you are not a federal contractor, your pricing may vary.